OVERVIEW

From 2020 to 2024, Tanzania experienced a surge in infrastructural development, aligning its strategic ambitions with the Third National Five-Year Development Plan (FYDP III), the Land Transport Regulatory Authority (LATRA) Strategic Plan, and the PPP Strategy FY2023/2024. This period has been marked by unprecedented investment in transport, energy, water, and information and communications technology (ICT), enabled by a stable macroeconomic environment, an expanding budget for public investment, and structural reforms to encourage private sector participation—particularly through public-private partnerships (PPPs).

Notably, Tanzania’s infrastructure upgrades supported its transition to a lower-middle-income country in July 2020, driving progress across urban and rural landscapes. The government, with robust development partners’ backing, scaled up access to transport and electricity, expanded digital infrastructure, and advanced the Water Sector Development Programme Phase III.

Advancements in regulatory frameworks for PPPs—including recent amendments to the PPP Act of 2018 and streamlined operational procedures—have opened new avenues for private capital and expertise. Yet, regulatory clarity, financial depth, and timely project delivery remain challenges. Within this context, consulting firms such as Lucent Advisory play a critical role in shaping sustainable infrastructure outcomes by delivering feasibility studies, financial modeling, capacity building, and contextualizing projects within the Tanzanian environment.

This article provides an in-depth examination of sectoral progress, key policies, the evolving PPP landscape, associated risks and opportunities, and the unique contribution of Lucent Advisory.

Government Policies Underpinning Infrastructural Development

- The Third National Five-Year Development Plan (FYDP III): 2021/22–2025/26

The FYDP III is the last in a series advancing the Tanzania Development Vision 2025, laying out a clear path for industrialization-led development, competitive regional integration, and inclusive socioeconomic transformation. FYDP III emphasizes leveraging Tanzania’s geographical advantages to create a regional manufacturing and logistics hub, promote digital transformation, and streamline human development—all underpinned by substantial infrastructure upgrades.

Key objectives of FYDP III relevant to infrastructure include:

- Accelerating industrialization through the expansion of manufacturing, energy, and logistics sectors.

- Enhancing the business environment and investment climate, notably through facilitating PPPs.

- Investing in science, technology, and innovation, thereby supporting next-generation ICT infrastructure.

- Strengthening public sector capacity, decentralizing development, and integrating regional and global priorities (SDGs, AU Agenda 2063).

To meet its ambitious goals, the FYDP III budgets TZS 223.6 trillion over five years, with TZS 74.2 trillion from the government development budget, TZS 19.6 trillion from other private sector contributions, and a targeted TZS 21 trillion in PPP investments—representing 17% of the total budget and 51% of private investment targets.

2. LATRA Strategic Plan 2020/21–2024/25

LATRA’s Strategic Plan serves as a roadmap for regulating and developing road, rail, and cable transport services, in line with national priorities and industrialization goals. The plan’s strategic focus lies in:

- Expanding quality, safe, and environmentally sustainable land transport.

- Digitalizing transport regulation and services (e.g., e-ticketing, vehicle tracking) for efficiency and transparency.

- Streamlining policy and operational frameworks for PPP projects, such as vehicle inspection centers and mass transit systems.

- Mainstreaming inclusivity, gender, and public health in transport provision.

LATRA’s achievements over this period include significant increases in licensed vehicles, rural and commuter connectivity, and advancements toward regulatory digitalization—facilitated by close alignment with FYDP III and PPP strategies.

3. PPP Strategy FY 2023/2024

The latest PPP Strategy signals a new era for PPPs in Tanzania, calling for mobilization of TZS 21 trillion in private capital from 2021/22 to 2025/26 to meet the country’s infrastructure targets. The focus is on sectors with the largest socio-economic impact and capital requirements: transport, energy, water, and ICT.

Core components of the PPP Strategy include:

- Pipeline development and project screening with focus on bankable projects (with feasibility studies prioritized).

- Early engagement of development partners and capitalization of the PPP Facilitation Fund.

- Establishment and operationalization of the PPP Centre as a dedicated “one-stop shop” for project management and investor support.

- Legal reforms to further streamline approval procedures, incentivize local content, allow international arbitration, and permit tax incentives for qualifying projects.

- Rollout of capacity-building programs and regulatory improvements (e.g., the PPP Act amendments of 2023).

These national policies are supplementing sectoral master plans—such as the Power System Master Plan 2020 Update and the National ICT Policy (2023)—and operational plans in water, transport, and energy.

Sectoral Highlights (2020–2024)

- Transport Sector

Roads, Urban Transit, and Railways

Tanzania experienced transformative changes in its road, bridge, airport, and rail systems, echoing the priorities embedded in the FYDP III and political manifestos. The government, through TANROADS and allied agencies, delivered:

- Over 2,500 km of new paved roads completed, with a further 6,000 km under construction or planned.

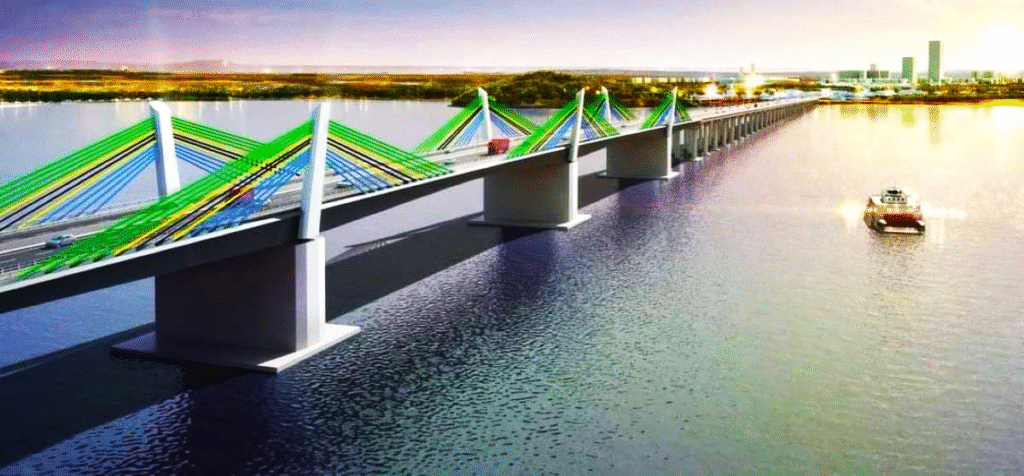

- Major urban decongestion works (e.g., inner and outer ring roads for Dodoma and Dar es Salaam, flyovers, and strategic bridges like Kigongo-Busisi and Tanzanite).

- Launch and expansion of the Bus Rapid Transit (BRT) system in Dar es Salaam—Africa’s largest BRT program—now transporting 150,000 passengers daily, with Phases II and III underway. PPP arrangements are being considered for Phases III–VI.

- Upgrades and expansion in aviation, including new terminals at Julius Nyerere International Airport and revamps at Mwanza, Geita, Mtwara, and other regional airports.

- Continuing the Standard Gauge Railway (SGR) project: construction between Dar es Salaam and Morogoro (91% achieved), extension toward Isaka and Mwanza, and new feasibility works for Mtwara–Mbamba Bay and Isaka–Rusumo–Kigali segments.

The outcomes include sharp reductions in travel time, urban congestion relief, improved road safety, and direct and indirect job creation for thousands of Tanzanians.

Regulatory and Digital Advances

LATRA has introduced and operationalized modern digital systems such as the Driver Testing Software, Vehicle Tracking System, and integrated e-ticketing. Regulatory reforms now promote eco-friendly transport modalities through compressed natural gas (CNG) and electric vehicles (EVs), broadening sustainability efforts and aligning with the National Environmental Policy.

PPP Integration

PPP participation in roads and mass transit is growing, with BRT phases, expressway developments (Kibaha–Chalinze–Morogoro), and major toll roads (such as Igawa–Tunduma and Uyole–Songwe Bypass) now at various pre-feasibility and procurement stages. Local investor participation is encouraged, with the PPP Centre proactively engaging domestic associations like TAMSTOA for BRT investment opportunities.

2. Energy Sector

Generation, Transmission, and Access

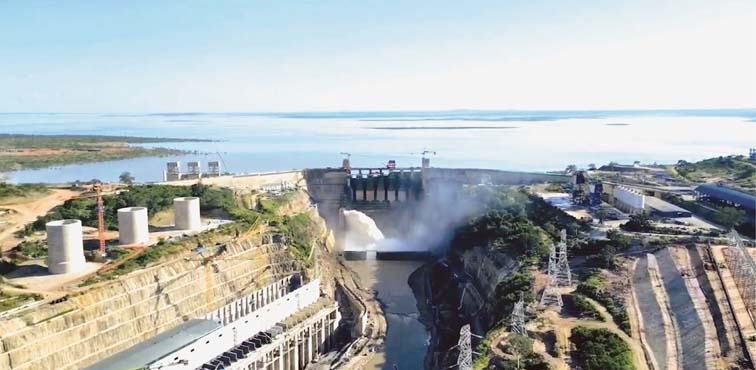

Tanzania expanded its installed generation capacity to over 3,400 MW by December 2024, up from below 2,000 MW in 2015—a 70% increase over less than a decade. The flagship Julius Nyerere Hydropower Project (2,115 MW) is nearing full commissioning, accounting for nearly 60% of national peak demand. Concurrently, new generation assets—Kinyerezi gas turbines, Kikonge (planned, 300 MW), Ruhudji (358 MW), Rumakali (222 MW), and a growing portfolio of solar, wind, and geothermal IPPs—diversify the energy mix.

Hydropower, natural gas, and new renewables will jointly drive toward the government’s target of:

- 75% household electricity access by 2030 (from 38% in 2020; 78.4% village electrification achieved by 2020, with connectivity rising from 46% to 100% by 2032).

- 12,255 MW installed capacity by 2030 and a more than threefold increase to 20,000 MW by 2044.

Transmission advances include over 8,000 km of high-voltage lines with cross-border interconnectors to Malawi, Kenya, Uganda, Rwanda, Burundi, and Zambia, enabling regional trade and grid stabilization.

Policy, PPPs, and Investment

Massive capital deployments are required—up to USD 38 billion by 2044—necessitating enhanced PPP frameworks, especially for large-scale renewables, distributed energy, and transmission. The revised PPP Act and energy sector reforms have prioritized:

- Private investment injection of at least $4 billion by 2030.

- New models (IPP, PPP, Design-Build-Operate-Maintain) for renewable and hybrid projects.

- PPPs in gas distribution (e.g., Dar es Salaam), solar and wind IPP tenders, and grid automation projects.

- Participation of international financiers—World Bank, African Development Bank, IFC, and others—in climate financing, transaction advisory, and guarantee structures.

3. Water Sector

Water Sector Development Programme Phase III (WSDP III), 2022/23–2025/26

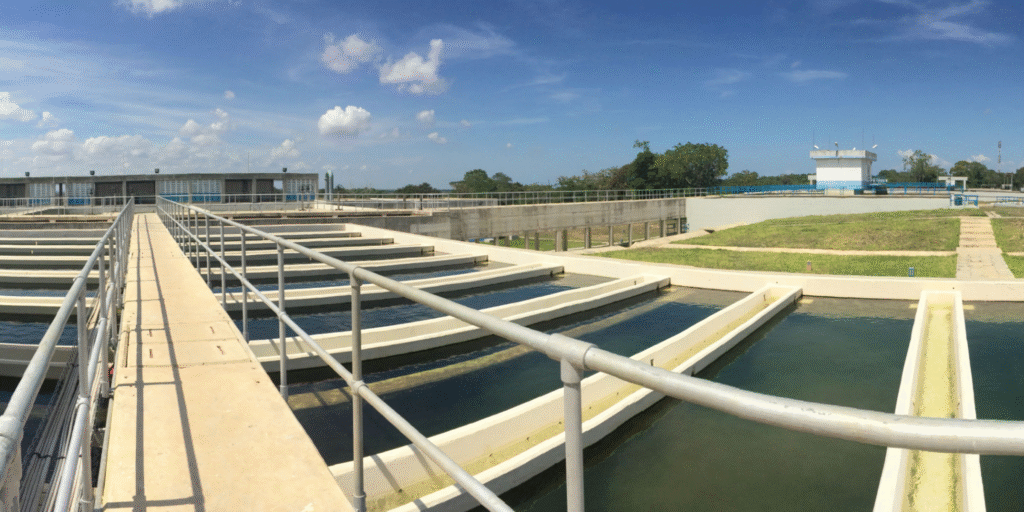

WSDP III is a USD 6.46 billion program targeting universal access to clean, affordable water and sanitation, in line with TDV 2025 and SDG 6. Achievements from previous phases include 72% rural and 86% urban access to clean water, upgraded water quality management, and advances in household sanitation infrastructure.

Key WSDP III investments:

- Water resources development (dams, inter/intra basin transfers): e.g., construction of Kidunda Dam (190 billion liters capacity, 20 MW hydropower, TZS 335.8bn).

- Urban water supply: 600,000 new connections, 3,600 km of new pipeline.

- Rural water supply: 60,139 households connected, 2,400 boreholes drilled.

- Sanitation: 3,000 km of sewer lines, 22 faecal sludge treatment plants, improved hygiene in 2,000 health care facilities.

- Water quality and conservation: ambient/directed monitoring and technical support for over 2,000 water sources.

PPP and private sector participation is being actively developed for both large-scale and small solutions—joint ventures, DBO contracts, utility management contracts, and sanitation PPPs (especially on performance-based models).

Governance, Risk, and Capacity Building

WSDP III underscores resilience to climate risks, improved regulatory oversight, and stakeholder engagement. Financial, operational, and policy risks are mitigated by diversified funding (grants, commercial loans, PPPs), technical audits, and the capacity-building of Community-Based Water Supply Organizations (CBWSOs), Water User Associations, and Water Supply and Sanitation Authorities (WSSAs). Lucent Advisory’s competencies are especially relevant here.

4. ICT Sector

Connectivity, Digital Economy, and Policy

Tanzania has achieved rapid advances in digital infrastructure, thanks to the National ICT Policy (2023) and investments under FYDP III. Highlights include:

- Expansion of the National ICT Broadband Backbone (NICTBB) to 13,000 km, connecting all regions and 109 local government authorities.

- 87 million mobile SIM cards, 48 million internet users, with mobile money accounts almost doubling to 61.8 million between 2021 and 2024, signifying deepened digital financial inclusion.

- Introduction of 4G in 55% of geographies and ongoing deployment of 5G in major cities.

- Competitive telecom markets, with no single operator holding more than 32% market share.

- Enactment of robust data protection laws, cybercrime statutes, and supportive regulations.

High-impact PPP initiatives target:

- Local assembly of ICT devices (e.g., computers, mobile phones), fiber manufacturing, and technology park development.

- Rural broadband—PPP models for last-mile connectivity, including “fiber-to-home” (FTTH), satellite, and mobile networks.

- E-services rollout (e-government, e-payment gateways, e-NIDA).

- Business Process Outsourcing (BPO) and IT-enabled services for job creation and international market expansion.

The government’s PPP strategy includes incentives and frameworks specifically tailored for technology ventures, joint ventures, and start-ups, signaling a commitment to develop domestic tech capacity.

Key Infrastructure Projects and Budget Allocations (2020–2024)

| Sector | Project/Description | Budget Estimate (TZS/US$) | Status/Timeline | Strategic Impact |

| Transport | Standard Gauge Railway (SGR): Dar–Isaka, Mwanza, expansions | ~TZS 7.5 trillion | 2020–2025; ongoing | Regional transit, trade, job creation |

| Bus Rapid Transit (BRT) Phases I–III, expansion to VI | $130 million (BRT II/III) | Ongoing; PPPs initiated | Urban mobility, employment, congestion reduction | |

| Kibaha–Chalinze–Morogoro Expressway | Not disclosed | Feasibility/procurement | Inter-regional trade, PPP pipeline | |

| Major Bridge projects: Kigongo-Busisi, Tanzanite, Wami, Pangani | Not specified | 2021-2025+ | Urban/rural connectivity | |

| Energy | Julius Nyerere Hydropower Project (2,115 MW) | ~TZS 7.6 trillion | 2019–2025; near complete | Base-load power, national electrification |

| Ruhudji (358 MW), Rumakali (222 MW), Kikonge (300 MW) hydropower | $1.8–2.1 billion (each) | Planning, procurement | Renewables, PPP pipeline | |

| Chalinze–Segera, Segera–Tanga, and interconnector lines | $242.6 million | 2023–2025+ | Grid stability, cross-border trade | |

| Water | Water supply and sanitation (rural and urban, WSDP III) | $2.6 billion (supply) | 2022–2026; ongoing | Clean water access, health, rural development |

| Kidunda Dam (water & power) | TZS 335.8 billion | 2023–2025; active | Drought resilience, multipurpose utility | |

| ICT | National ICT Broadband Backbone (expansion) | $110 million | 2020–2025; ongoing | Digital economy, e-government |

| ICT assembly, tech parks, rural connectivity projects | $139.9–$752.1 million | 2022–2025; pipeline | Local manufacturing, job creation | |

| Other | Port upgrades (Dar es Salaam, Bagamoyo), new airports, PPP sanitation | $421+ million (ports) | 2020–2025; ongoing | Trade, logistics, environmental health |

Sources: FYDP III, Ministry of Finance, PPP Centre, World Bank, Daily News, TIC, sectoral status reports

Analysis: The above table illustrates both the scope and scale of Tanzania’s infrastructure ambitions and the centrality of PPPs in financing and operationalizing these projects. For instance, government-funded components of the SGR and JNHPP represent some of the largest sectoral investments in sub-Saharan Africa, but moving forward, such projects are increasingly leveraging mixed capital structures and PPP modalities.

PPP Risks and Opportunities: Assessing the Terrain

Legal and Regulatory Framework

Structure and Strengthening Reforms

Tanzania’s PPP environment has undergone a comprehensive transformation, with foundational laws (PPP Act 2010, as revised 2018 and amended 2023) and PPP Regulations (2020, amended 2023) establishing:

- The PPP Centre as a “one-stop shop” for project approval, facilitation, capacity-building, and investor support.

- Mandatory feasibility studies and value-for-money assessments for all proposed PPPs.

- A multi-tier project approval system now streamlined—requiring pre-feasibility and full feasibility studies, Steering Committee review, and Cabinet approval for strategic projects.

- Competitive bidding as a default, with structured exceptions (direct negotiation or special arrangement permitted for urgent, proprietary, or strategic projects).

- Allowance for international arbitration and dispute resolution under ICSID and investment treaties.

- Viability gap funding (VGF), tax and non-tax incentives, and local content requirements to tilt the PPP environment toward both bankability and developmental impact.

Recent Innovations: The 2023 PPP Amendment Act now requires all PPP projects to be implemented through special purpose vehicles (SPVs) and allows public entities up to 25% ownership of these SPVs, introduces additional dispute resolution mechanisms, and removes barriers to granting tax incentives to qualifying PPP projects.12

Gaps and Ongoing Challenges:

- Despite advances, many government agencies still lack deep PPP experience, resulting in poor financial modelling, suboptimal risk allocation, and over-reliance on government guarantees.

- Regulatory overlaps, particularly with sector-specific laws and investment codes, can slow procurement.

- Monitoring and reporting requirements—while robust in statute—require stronger enforcement and transparency.

- Clarity around local versus international arbitration, profit repatriation, and regulatory certainty continues to be a concern for risk-averse investors.345

Financial, Market, and Execution Risks

Capital Mobilization and Market Constraints

- Financial Depth: Local capital markets remain underdeveloped, limiting large-scale domestic private sector financing. This places a heavier reliance on DFIs, commercial banks, and international consortia for major infrastructure projects.

- Revenue Risk: PPPs, especially toll roads and utilities, struggle with user affordability, low willingness to pay, and the slow uptake of cost-reflective tariffs. State-owned off-taker (e.g., TANESCO) credit risk is a well-known constraint for energy PPPs.

- Foreign Exchange Risk: Large PPP projects denominated in foreign currency are exposed to TZS devaluation, with limited hedging available.

- Payment and Budget Delays: Multi-year commitments by government agencies can be unreliable in the absence of dedicated escrow or guarantee instruments.

Execution Risks

- Bureaucratic Delays: Lengthy procurement and approval processes, land acquisition issues, and stakeholder misalignment can result in project delays and cost overruns.

- Capacity Gaps: Contracting authorities and even local consultants often lack track record or technical competence in project finance, risk modeling, and modern PPP structures6.

- Transparency and Governance: Instances of unclear appraisal, opaque negotiations, and inconsistent application of preference schemes have at times undermined investor confidence.

Political Risks

Stability and Predictability

- Tanzania is considered politically stable, but shifts in policy priorities, election cycles, or changes in sectoral leadership can affect project timelines, priorities, or contractual enforcement.

- Central–local alignment varies; decentralized projects (water, rural roads) can be delayed by regional-level politics and weak capacity or coordination at lower government tiers.

- Investment protection remains strong in law, but anecdotal cases of retrospective tax impositions and enforcement weaknesses are reported by international rating agencies.

PPP Opportunities by Sector

Transport

- Expressways (Kibaha–Chalinze–Morogoro, Igawa–Tunduma), BRT expansion, and rail infrastructure are PPP-ready. Feasibility studies and preferred bidder stages are progressing, with several routes in preparation for tender or negotiation.

- Port upgrades, dry ports, and logistics parks, particularly at Dar es Salaam and Bagamoyo, are actively seeking international PPP partners.

- Opportunities exist for local investors to partner on operational concessions, particularly for BRT bus operations and maintenance, through association-backed consortia.

Energy

- New IPPs, renewables (solar, wind, geothermal), gas distribution networks, and decentralized microgrid projects are prioritized in the national PPP pipeline.

- Transmission lines, interconnections, and smart metering present bankable PPP opportunities, subject to improvements in off-taker arrangements and cost recovery mechanisms.

- New amendments allow for structured tax incentives, arbitration, and streamlined procurement.

Water

- The WSDP III specifically earmarks rural and urban water supply, sanitation, wastewater, and desalination plants for PPP engagement, with both large DBO (design-build-operate) and performance-based contracts open for private participation.

- Multiple pilot PPPs on NRW reduction, utility management, and private delivery of rural schemes provide replicable success templates.

ICT

- PPPs for terrestrial and submarine fiber expansion, rural mobile/broadband rollouts, assembly plants, and tech parks are gaining momentum.

- The PPP legal environment explicitly recognizes PPPs as a preferred delivery mode for ICT infrastructure and digital innovation, encouraging joint ventures and start-up ecosystem development.

Table: Selected PPP Pipeline Projects FY2023/2024

| Project | Sector | Status | Budget/Capacity | PPP Model |

| Kibaha–Chalinze–Morogoro Expressway | Transport | Feasibility | N/A | Toll Road PPP |

| BRT Phases III/IV | Transport | Procurement | $130M+ | O&M Concession/PPP |

| Igawa–Tunduma Toll Road | Transport | Prefeasibility | 218 km | Toll Road PPP |

| Bagamoyo Port | Transport | Pipeline | >$421M | Port Concession |

| Dar Commuter Rail | Transport | Pipeline | N/A | O&M Concession/PPP |

| Ruhudji Hydropower Project (358 MW) | Energy | Financial closure | $968.37M | BOO/BOOT IPP |

| Rumakali Hydropower Project (222 MW) | Energy | Financial closure | $634.5M | BOO/BOOT IPP |

| Gas Distribution (DSM, Lindi, Mtwara) | Energy | Pipeline | N/A | Distribution Concession |

| ICT Backbone & Data Centers | ICT | Feasibility/prep | $110M+ | Design-Build-Own-Operate |

| Water Utility Management PPPs | Water | Pipeline | $2.6B (WSDP III total) | Management/O&M/PPP |

Lucent Advisory’s Role: Strategic Positioning in Sustainable Infrastructure

Company Profile and Service Offering

Lucent Advisory is a leading indigenous Tanzanian business firm distinguished for its deep expertise in advisory, accounting, assurance, taxation, and financial services. The firm is highly regarded for its multidisciplinary approach, integrating international standards with Tanzanian socio-economic realities to ensure optimal outcomes for both local and foreign investors. Lucent is actively involved in:

- Advisory services such as transaction, M&A, project structuring, and business transformation.

- Project finance consulting in infrastructure, focused on transport, energy, water, agriculture, fishing, manufacturing and ICT sectors.

- Capacity-building and research to empower both public sector clients and private enterprises.

- ESG strategy integration, governance frameworks, and compliance advisory.

Feasibility Studies Expertise

Lucent Advisory’s feasibility studies provide the analytical backbone for PPP project development, satisfying statutory requirements under the PPP Act and meeting international standards. Typical engagements cover:

- Comprehensive financial, technical, and socio-economic viability analyses.

- Risk allocation and mitigation frameworks tailor-suited to Tanzanian legal and market conditions.

- Cost–benefit assessments comparing public provision and PPP solutions.

- Sector-specific modeling (e.g., traffic and ridership for transport, load forecasting for energy, tariff revenue projection for utilities).

Notably, Lucent has supported LATRA’s vehicle inspection center PPPs and contributed to water utility performance contracts.

Financial Modeling Capability

Lucent’s modeling services encompass project finance, cash flow projections, risk analysis, and optimization of funding structures. The firm employs:

- Detailed tariff and payment mechanism modeling to inform deal structure and bid documentation.

- Scenario analyses accommodating inflation, currency risk, and capital cost pressures.

- Sensitivity analyses for user demand, cost recovery, and value-for-money assessments.

- Structuring of SPVs, joint ventures, and capital stack optimization—addressing local and international creditor/investor requirements.

Lucent’s input is essential for bankability, supporting both government contracting authorities and private bidders.

Capacity Building and Local Contextualization

Lucent’s programs address persistent knowledge gaps in PPP lifecycle management, policy coherence, financial reporting, and compliance. Key offerings include:

- PPP curriculum and workshops for government and private sector staff at all levels.

- Targeted leadership training for regulatory and transaction management officials.

- Community and stakeholder engagement to ensure buy-in and smooth project rollout.

Local contextualization means tailoring global best practice to domestic needs—such as integrating gender, HIV/AIDS, and inclusivity mandates in sector projects, and ensuring donor and state priorities are met without loss of project efficiency.

Strategic Positioning in Sustainable Infrastructure Delivery

Lucent’s reputation as a trusted advisor is reinforced by:

- Rigorous professionalism and high ethical standards, as reflected in strong client testimonials and repeat engagements.

- Commitment to ESG and climate-sensitive advisory, aligning with Tanzania’s sustainable development ambitions and international partnership goals.

- Proven ability to “translate” complex regulatory, cultural, and technical demands into actionable, bankable projects for both local and international stakeholders.

Lucent’s practical engagement with policy frameworks (LATRA, WSDP III, PPP Centre, and FYDP III) and presence in project design, execution, and capacity-building positions the firm as a linchpin for future PPP and infrastructure success.

Conclusion

Between 2020 and 2024, Tanzania achieved significant progress in infrastructural development, underpinned by bold policy choices, substantial budget allocations, and targeted international cooperation. Landmark achievements in transport, energy, water, and ICT sectors underscore the power of public investment—augmented, increasingly, by robust PPP models. At the same time, the landscape remains complex; regulatory, financial, and political risks persist, and effective PPP implementation requires nuanced, context-sensitive, and highly competent transaction leadership.

This is the environment in which Lucent Advisory excels. By combining deep local knowledge with sophisticated financial and technical skills, Lucent is strategically positioned to unlock PPP project value, ensure feasibility and bankability, strengthen institutional capacities, and tailor sustainable solutions for both the Tanzanian government and private sector partners. Through its integration in project finance, feasibility, and capacity-building, Lucent Advisory empowers Tanzania to bridge its infrastructure gap, create lasting value, and realize the promise of an industrialized, digitally integrated, and sustainable future.

- https://bowmanslaw.com/insights/tanzania-amendments-to-the-ppp-act-herald-a-new-era-in-ppp-development/ ↩︎

- https://www.parliament.go.tz/polis/uploads/bills/1676017077-document%20%2847%29.pdf ↩︎

- https://ticgl.com/economic-evaluation-of-tanzanias-public-investment-projects-2020-2025/ ↩︎

- https://www.mof.go.tz/uploads/documents/en-1716298280-MKAKATI%20WA%20UTEKELEZAJI%20WA%20SERA%20YA%20PPP.pdf ↩︎

- https://www.pppcentre.go.tz/uploads/documents/en-1725215084-PPP%20participation%20in%20roads%20infrastructure%20construction%20projects%20in%20Tanzania.pdf ↩︎

- https://www.pppcentre.go.tz/uploads/documents/en-1725215084-PPP%20participation%20in%20roads%20infrastructure%20construction%20projects%20in%20Tanzania.pdf ↩︎